The Rise of Zero-Shot Modeling

Artificial intelligence is reshaping economics. A key innovation is the zero-shot model, AI, thatcan solve tasks it was never trained on. For economists, this means faster forecasts, new ways

to use data, and insights without custom-built models

Why Zero-Shot Matters

Speed and Scale: Economists usually build new models for each case. Zero-shot systems

adapt instantly, saving time and effort.

Bridging Data Gaps: In regions with scarce data, zero-shot approaches provide useful insights.

Merging Text and Numbers: Zero-shot AI can read corporate transcripts, central bank

minutes, and combine them with data. This creates richer economic signals.

According to McKinsey, generative AI could add $2.6–$4.4 trillion annually to the global

economy. (McKinsey)

Evidence From Research

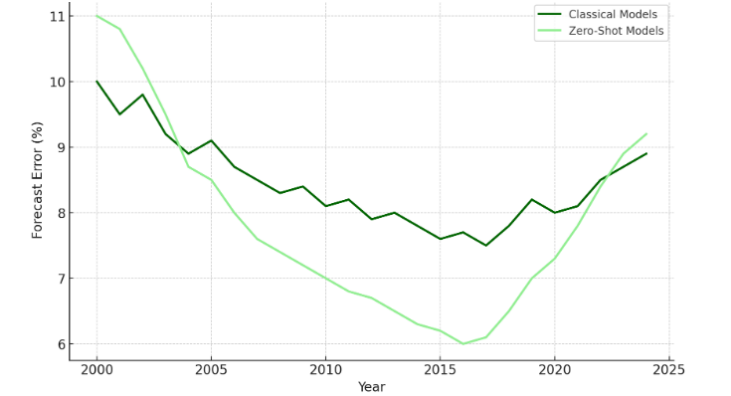

Studies show that time-series foundation models (TSFMs) can forecast GDP in zero-shot mode.

They perform well in stable periods but weaken during shocks. (Arxiv)

Figure 1. Performance of Zero-Shot Models vs. Classical Forecasting (2000–2024)

Zero-shot learning also predicts the S&P 500 index from constituent data with strong accuracy.

And text-based models already classify financial disclosures effectively. (BIS, PLOS)

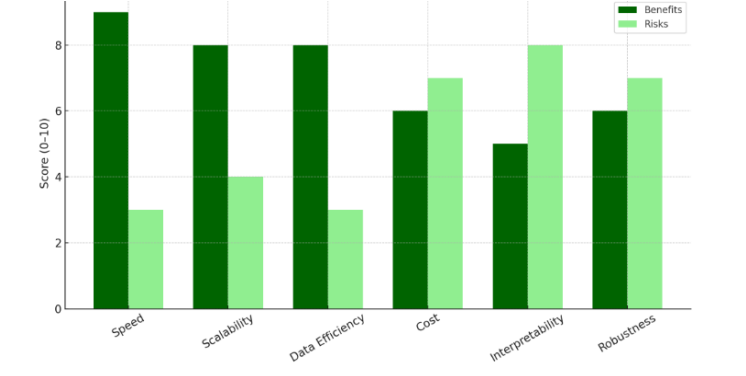

Opportunities and Risks

Opportunities:

- Faster deployment

- Insights into poor data areas

- Integration of text and data

Risks:

- Fragility during crises

- Overconfident predictions

- High computational cost

Figure 2. Potential Benefits vs. Risks of Zero-Shot Models

How to Adapt

Businesses and policymakers should:

- Mix zero-shot AI with traditional econometrics.

- Add safeguards for shocks.

- Monitor results continuously.

- Document limitations for transparency.

How TAMVER CONSULTING Helps

At TAMVER CONSULTING, we guide clients through the new frontier of AI-driven economics.

Our services include:

- Custom AI Strategy: Integrating zero-shot models into existing workflows.

- Risk Management: Building safeguards for economic shocks.

- Data Solutions: Using zero-shot models to fill gaps where traditional data is limited.

- Training & Foresight: Equipping teams with skills to adapt to fast-moving AI trends.

We help businesses and policymakers embrace zero-shot models responsibly, ensuring

resilience and competitiveness in a changing world.

Conclusion

Zero-shot models are not flawless. But they are a powerful new tool for economics. Those who

adopt early, with the right safeguards, will shape the next generation of economic analysis

References