The Rising Threat of BEC Attacks

Business Email Compromise (BEC) attacks have become a significant concern for European companies in 2024, posing a severe threat to their financial security. These sophisticated cyberattacks involve criminals impersonating high-level executives or trusted business partners to deceive employees into transferring funds or sharing sensitive information. As organisations continue to rely heavily on digital communication, the risk of falling victim to BEC scams has increased dramatically.

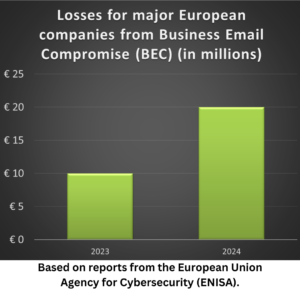

Recent statistics reveal a worrying trend in the frequency and impact of BEC attacks across Europe. In 2023, the European Union Agency for Cybersecurity (ENISA) reported a 40% increase in BEC incidents compared to the previous year. Furthermore, in 2024, it is expected that the number of BEC attacks will continue to rise, with major European companies being hit by incidents resulting in losses upwards of €20 million. This surge has prompted cybersecurity experts to warn European businesses about the urgent need to enhance their defences against these evolving threats.

How BEC Attacks Work

Understanding the mechanics of BEC attacks is crucial for organisations looking to protect themselves. These scams typically follow a well-crafted pattern:

- Research and Targeting: Cybercriminals meticulously research their targets, gathering information about the company’s structure, key personnel, and ongoing business activities.

- Email Spoofing: Attackers create convincing email addresses that closely resemble those of legitimate executives or partners.

- Social Engineering: Using persuasive language and urgent requests, criminals manipulate employees into taking action without proper verification.

- Fund Transfer or Data Theft: The ultimate goal is often to trick victims into transferring money to fraudulent accounts or sharing sensitive company information.

The sophistication of these attacks has increased significantly in 2024, with criminals employing advanced AI tools to craft more convincing messages and even mimic voice patterns in phone calls.

Industries at Risk

While BEC attacks can target any organisation, certain industries in Europe have proven particularly vulnerable:

- Financial Services: Banks and investment firms are prime targets due to their access to large sums of money and sensitive client data.

- Manufacturing: Companies with complex supply chains and frequent international transactions are often targeted.

- Healthcare: The healthcare sector’s valuable patient data and critical financial operations make it an attractive target for cybercriminals.

- Energy and Utilities: These essential services are targeted for their critical infrastructure and potential for causing widespread disruption.

Understanding which sectors are most at risk can help organisations in these industries take proactive steps to enhance their financial security measures.

The Financial Impact of BEC Attacks

The financial consequences of BEC attacks on European companies have been staggering. In 2023, the average cost of a successful BEC attack in Europe was estimated at €1.8 million, with some high-profile cases resulting in losses exceeding €10 million. In 2024, these costs have soared, with some companies losing over €15 million due to BEC attacks. Beyond immediate financial losses, companies often face long-term repercussions, including:

- Damage to reputation and loss of customer trust

- Legal and regulatory penalties

- Increased cybersecurity insurance premiums

- Costs associated with investigating and recovering from the attack

These far-reaching consequences underscore the importance of robust financial security measures and comprehensive cybersecurity strategies.

Prevention Strategies for European Companies

To combat the rising threat of BEC attacks, European companies must adopt a multi-layered approach to cybersecurity:

- Employee Training: Regular, comprehensive training programmes can help staff recognise and report suspicious emails or requests.

- Multi-Factor Authentication: Implementing strong authentication measures for email accounts and financial systems can prevent unauthorised access.

- Email Filtering and Verification: Advanced email security solutions can detect and flag potential BEC attempts before they reach employees.

- Payment Verification Protocols: Establishing strict procedures for verifying and authorising financial transactions can thwart fraudulent transfer requests.

- Cybersecurity Culture: Fostering a company-wide culture of cybersecurity awareness is crucial for maintaining vigilance against evolving threats.

By implementing these strategies, companies can significantly reduce their vulnerability to BEC attacks and enhance their overall financial security.

The Role of AI in Combating BEC Attacks

As cybercriminals leverage AI to enhance their attacks, European companies are turning to AI-powered solutions to bolster their defences. Advanced machine learning algorithms can:

- Analyse email patterns to detect anomalies indicative of BEC attempts

- Identify subtle linguistic cues that may signal fraudulent communication

- Continuously adapt to new attack vectors and techniques

While AI offers promising tools for combating BEC attacks, it’s essential to remember that technology alone is not a panacea. A comprehensive approach that combines technological solutions with human vigilance and robust processes remains the most effective defence against these sophisticated threats.

As we move further into 2024, the landscape of BEC attacks targeting European companies continues to evolve. The financial stakes are higher than ever, with cybercriminals employing increasingly sophisticated tactics to breach corporate defences. However, by staying informed about the latest trends, implementing robust prevention strategies, and fostering a culture of cybersecurity awareness, European businesses can significantly enhance their resilience against these threats.

The battle against BEC attacks is ongoing, and vigilance is key. As cybercriminals adapt their tactics, so too must companies evolve their defences. By prioritising financial security and investing in comprehensive cybersecurity measures, European organisations can protect themselves against the potentially devastating impact of BEC attacks in 2024 and beyond.

Don’t wait until it’s too late. Call us now or fill out the form below, and our specialists will provide you with a consultation to help protect your company from BEC attacks and strengthen your cybersecurity measures. Your financial security is our priority.